Health insurance for growing families

Offering outstanding value health insurance for families is important to us, and we’re proud of the awards we’ve won that prove it. Our Gold Ultimate hospital cover includes cover for pregnancy, providing support from planning to birth and beyond.

Switch Now for 6 Weeks Free!*

PLUS we'll waive 2 month waiting periods on Extras* when you join on any Combined Hospital and Extras cover by 27 April 2025! Use promo code SWITCH25 when joining.

We’ve worked hard to offer incredible value for money health insurance for families just like yours. Westfund helps you avoid the unexpected costs of health care with unlimited emergency ambulance included as standard, no excess payable for kids on Gold and Silver tier hospital cover and a national Provider of Choice network to help you reduce or eliminate out-of-pocket costs for selected treatments when going to the dentist.

Feel secure in knowing your family is covered.

A broad range of family-focused benefits

Enjoy cover for common hospital treatments, including; tonsils, adenoids and grommets, ear, nose and throat, as well as benefits for dental, physiotherapy and chiropractic.

Protect your growing family, plan for the unexpected

Our Gold Ultimate Hospital covers pregnancy and birth, assisted reproductive services, and you’ll pay no excess for kids or accidents when admitted to a private hospital.

Happy members

We’re rated 4.6/5 on Productreview.com.au (as of April 2024).

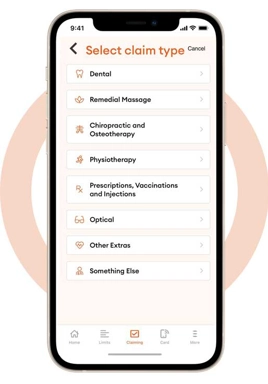

Easy on-the-spot claims

Take the stress out of managing payments for extras with easy on-the-spot electronic claiming, or through the Westfund App.

Ready to join Westfund?

Find your cover or read more about our most popular health insurance options for growing families below.

Cover for what you need.

Gold Ultimate Hospital

Families from $123.87 per week*

Our top Hospital cover with no exclusions or restrictions. Health insurance suited to people who want peace of mind with our most comprehensive cover and complete access to our Health and Wellbeing Program range. Includes top cover for families with pregnancy, birth and IVF included.

- Only available when packaged with an extras cover.

- Pay no excess for kids. Pay no excess for accidents when admitted to a private hospital.

- Complete access to our Health & Wellbeing Program range.

- Travel & Accommodation benefits to support members needing to travel for care.

Mid Extras

Families from $21.57 per week^

Good Extras health insurance suited to families wanting cover for key services such as optical, dental (including orthodontic), physio and chiro. Offers good value for growing families with benefits to put towards a broad range of Extras including mental health support, massage, vitamins and nutrition.

- Only available when packaged with a hospital cover.

- Allows you to use your dental cover as you need, with $1125 per person, per calendar year (not including orthodontic).

- $2,500 lifetime limit on orthodontic.

- $120 per policy, per calendar year to put towards antenatal and postnatal classes.

Footnotes

* Based on NSW prices, including $750 excess and Base Tier Australian Government Rebate for under 65. Does not include Lifetime Health Cover loading or Age-Based Discount. Family price covering dependants under 25. Prices effective 1 April 2024.

^Based on NSW prices, including Base Tier Australian Government Rebate for under 65. Family price covering dependants under 25. Prices effective 1 April 2024.

Switching to Westfund is easy

30-day guarantee.

You can try us for 30 days, if you decide to cancel we’ll refund any premiums paid — as long as no claims are made.

You won’t re-serve waiting periods.

When you transfer to an equivalent or lower level of cover.

We’ll take care of the hard stuff.

We can cancel your old policy for you and handle all the paperwork; all you'll need to do is cancel your direct debit with your previous fund.

And we're easy to use

Easy claiming for the day-to-day.

For extras, easy on-the-spot electronic claiming, or though the Westfund App.

Expert help when you need it.

With call centres across NSW and Queensland, we have local teams ready to answer your questions.

We’re here to help

Speak to one of our experts about your needs at a time that suits you – we’re available over the phone, email, webchat or at your local branch. We’re here to help.