Health insurance for young adults

We know your health and wellbeing are important to you – but so is making smart financial decisions. That’s why we offer health insurance for young adults at a fair price to cover everything you need to prioritise your health.

Switch Now for 6 Weeks Free!*

PLUS we'll waive 2 month waiting periods on Extras* when you join on any Combined Hospital and Extras cover by 27 April 2025! Use promo code SWITCH25 when joining.

Save up to 10% on your hospital premium with Westfund

If you sign up for health insurance with Westfund before you turn 30 you can lock in savings of up to 10% … for the next ten years!! That means you could save an extra 10% off the hospital premium price. It’s an awesome program we call Age-Based Discounts. To lock in savings, members need to maintain their hospital cover. Read more about eligibility here and give us a call to lock in your saving today.

Take advantage of knowing you’re covered.

Avoid paying the Medicare Levy Surcharge (MLS)

Secure affordable single Bronze Plus hospital insurance from $25.50 a week** to avoid MLS if you're earning more than $97K, and save up to 10% on hospital premiums if you're under 30 with an Age-Based Discount.

Easy to use and available all over Australia

Our people are available to help via webchat, email and phone. Our online services are available 24/7 for easy claiming.

Accidents happen. Make sure you’re covered

Ambulance trips could set you back thousands. Our covers include unlimited emergency ambulance cover. Plus, with eligible hospital and extras you will have access to elective surgery and physio if you need it.

Good extras cover to look after your wellbeing

Benefits to help you look after your health with physio, massage and dental as well as cover for optical, gym memberships and vitamins.

Ready to join Westfund?

Find your cover or read more about our most popular young adult health insurance options below.

Cover for what you need.

Starter Extras

Singles from $5.47 per week^

Extras health insurance best suited to fit and healthy singles and couples. Value for money Extras cover with grouped benefits meaning you choose where to spend your limits across services like optical, physio, chiro, vitamins, massage, acupuncture, mental health support and more (sub-limits apply).

- Includes general dental cover + an optical benefit up to $180 per person, per calendar year.

- Choose how to spend $400 per person, per calendar year to manage your health across a great range of therapies and providers.

- Includes benefits to put towards managing mental health

Bronze Hospital

Singles from $21.05 per week*

Entry-level Hospital cover. Focuses on common treatments like ear, nose and throat services, joint reconstructions and more. Health insurance designed for cost-conscious singles, couples and families looking for cover that provides reassurance and security.

- Eligible for Age-Based Discounts for adults under 30 to save up to 10% on their premiums.

- Includes weight management and cancer support programs.

Bronze Plus Hospital

Singles from $23.00 per week*

Entry-level Hospital cover with a bit extra. Focuses on common treatments like ear, nose, throat, hernias & appendix plus dental and podiatric surgery. Health insurance designed for young, healthy people and families who are just starting out.

- Eligible for Age-Based Discounts for adults under 30 to save up to 10% on their premiums.

- Includes unlimited emergency ambulance cover with Westfund recognised providers

Footnotes

* Based on NSW prices, including $750 excess and Base Tier Australian Government Rebate for under 65. Does not include Lifetime Health Cover loading or Age-Based Discount. Prices effective 1 April 2024.

^Based on NSW prices, including Base Tier Australian Government Rebate for under 65. Price effective 1 April 2024.

**Based on NSW prices, including $750 excess and Tier 1 Australian Government Rebate for under 65. Does not include Lifetime Health Cover loading or Age-Based Discount. Prices effective 1 April 2024.

Don’t get caught out.

We get it. Health insurance can be confusing. But putting off signing up could mean you pay more now and in the future.

We’ve broken down the three Government programs that you should be aware of. Still have questions? Call us today and we’ll help unpack the lingo.

1. Lifetime Health Cover

An incentive to encourage young people to take out hospital insurance and maintain coverage. If you choose to not get hospital cover before you turn 31, you will pay an extra two per cent on your hospital premium for each year after 30 until you do join. So if you decide to take out hospital cover at 40, you will be paying 20% more than a friend who took out insurance at 30 … for exactly the same cover. The maximum loading you can be charged is 70% and the loading is only removed after 10 years of continuous hospital cover.

Learn more.

2. Age-Based Discount

Savings on your hospital premium of up to 10% if you take up cover before you’re 30. The younger you join, the larger your discount. As long as you maintain eligible hospital cover, you will get this discount until you turn 41, after which it will reduce by two per cent each year until you get back to zero. So, if you take up cover before 25, that means you’re saving on your premiums until you’re 45! No brainer right? Not all insurers offer this discount. Luckily, we do.

3. Medicare Levy Surcharge

Additional tax you pay if you do not have private hospital cover and earn above a certain income. For singles, the threshold is $97,000 and for families, it is $194,000. This is in addition to the compulsory Medicare Levy of two per cent, which is paid by most Australians to help fund Medicare. You can avoid the surcharge if you take out an appropriate level of hospital cover.

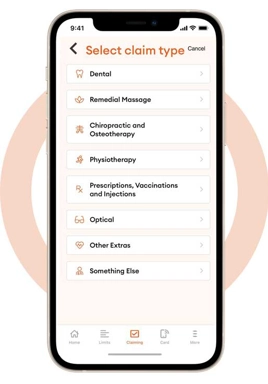

We're easy to use

Easy claiming for the day-to-day.

For extras, easy on-the-spot electronic claiming, or though the Westfund App.

Expert help when you need it.

With call centres across NSW and Queensland, we have local teams ready to answer your questions.

We’re here to help

Check out our full range of singles health insurance and private health insurance for young adults online. If you need help unpacking what’s best for you, you can speak to one of our experts available over the phone, email, webchat or at your local Care Centre. We’re here to help, and we won’t keep you waiting.